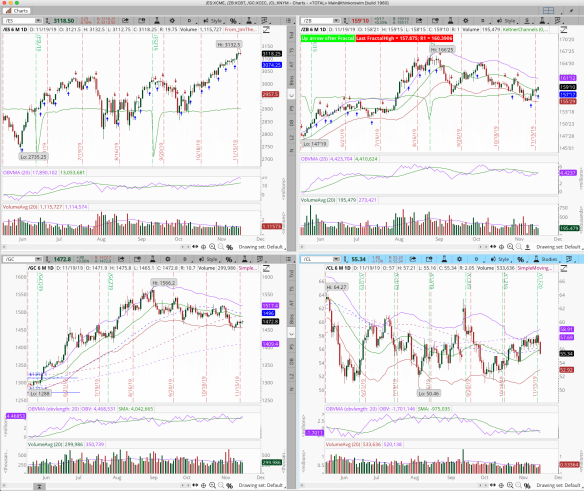

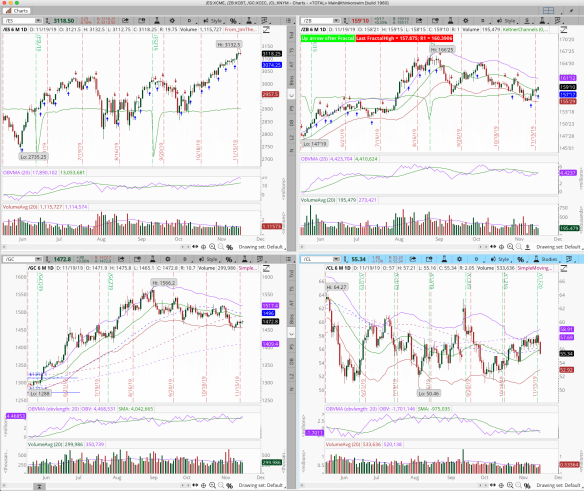

Starting with the /ES Bullish, /ZB Neutral to Bearish, /GC Neutral and /CL is Bearish.

Starting with the /ES Bullish, /ZB Neutral to Bearish, /GC Neutral and /CL is Bearish.

This is quite a push. Maybe now that QE mini is back we will see this continue. Remember to trade what you see. What I see is that we have new highs with on balance volume well above the average. Price up OBV up means strong positive delta trading. I will explain what this means soon in a video.

/ES S&P

Boy I sure should follow my trade plan. If I had I would still be long the SPY. This just reinforces the need to stay on plan. This move above the previous resistance is pretty strong. It look for a little bit that the volume was not there. Now we just have to wait for the pull back. going to see where it comes back to. Once the swing high gets established I will have some levels to work with.

USD/CAD

The dollar is finally giving up the ghost. I was talking with some trading friends and they put it well. They said it looks like inflation is coming. So the big guys are setting up for this. Dollar down gold up.

/CL

Barring a catastrophe, Oil is bottomed out. Down trend is over for now. Look for a swing high pull back. May not be far from here.

/GC

I have swing trades on for the GDX and GLD. If the inflation play is on this will head to higher ground. I went back a couple of years and found the level that I placed on this chart. See if pulls it up. We do not have a swing high.

ES S&P 500

No real change from last weeks look. I think the Fed and Oil is trying to make moves to save this level. Personally I feel they will fail just not sire how long it will take. I am out of everything at present.

USD/CAD

Same as before, The are 1.37 is holding. I keep hoping for it to come below. When I say hope there is no technical reason for it to hold. Pretty simple. If the 1.37 does not hold then see how long it trades at the 1.34 area.

CL Oil

Interesting thing this week as Saudi Arabia, Iran and Russia talked about holding this record level of production. Let’s see who blinks. I say this area holds unless they turn down the spickets. You can see the levels that are in play now. See if it can form a bottom. Another note I received a signal to short today. I chose not to take it because I think they will manipulate. I also would like to see more room to move. These are excuses. We shall see if my feelings are warranted. It sure makes a trading system hard to measure when I do this kind of thing.

GC Gold

No changes really from last week. It did move above the level I discussed however came right back to hold 1240. I should be long this but missed it the day I received the signal. I missed the GDX also. Man I hate it when that happens.

ES trading sideways here at a top. tops take longer to form than bottoms. This is twice that it has tested both resistance and support. Look for it to move to support. Might want to sell half at this point and set a close stop on the short. May get a runner to the downside.

CL is looking good for a call. Still no clear resistance. look for a pull back then move higher.

GC Head and shoulders forming. See what happens with the neck line bottom.

USD/CAD Making a move to the support area. When it gets here see how it behaves before next position. Now would be a good time to get rid of half of the short.

My overall thoughts on the markets. ES is going to be more quiet on the top here. Fed has too much control. I think topping pattern and then down. However the wildcard is the Fed coming to the rescue. Read above on the rest. Happy trading!!

It has been a while since I posted. This chart is a pretty simple read. We are pushing up against the 78.6 Fib extension level. I am long for the last couple of weeks SPY QQQ DIA XLK XLB and XLV. This is really bullish trading out of the consolidation of the last month or more. Watch this level 1925 should see a pull back going into the end of the week. What I think is going to happen though is we consolidate for the next move higher. The On Balance Volume is rocking on almost every sector. The only potential short is the XLE Energy sector. Price is too strong though at this point to get the short. For the most part I am riding this swing and waiting for the next opportunity. Happy trading.

The Bears are dancin’. I felt that if we broke the 1812.50 area that we would trade for a while in the 1774-1812.50 area. Market traded down to 1774 for a bit held there for a few days and today the bottom fell out. I still am thinking this is just a correction. Look for the 35 to hold. If we can not muster a bounce here then we will see 25 area and very likely we see 1705 which happens to be the monthly S2. I still do not have a longer term short signal for the S&P. The Dow is another story I got a short signal on it last week. I am doing well with this market. Started picking up a few shorts 2 weeks ago. All of these positions are risk free trades. I am long GLD with full risk and did place a trade for MSFT long today. Taking a little heat on MSFT but it should be ok. Gold has broken a downtrend line and is seeing volume come in. I also entered a long position on KRED. This is a position trade meaning I like the story. Nothing to do with the chart. I entered it at .75. Hope this helps…Happy Trading!!!!

The Bears are dancin’. I felt that if we broke the 1812.50 area that we would trade for a while in the 1774-1812.50 area. Market traded down to 1774 for a bit held there for a few days and today the bottom fell out. I still am thinking this is just a correction. Look for the 35 to hold. If we can not muster a bounce here then we will see 25 area and very likely we see 1705 which happens to be the monthly S2. I still do not have a longer term short signal for the S&P. The Dow is another story I got a short signal on it last week. I am doing well with this market. Started picking up a few shorts 2 weeks ago. All of these positions are risk free trades. I am long GLD with full risk and did place a trade for MSFT long today. Taking a little heat on MSFT but it should be ok. Gold has broken a downtrend line and is seeing volume come in. I also entered a long position on KRED. This is a position trade meaning I like the story. Nothing to do with the chart. I entered it at .75. Hope this helps…Happy Trading!!!!